Home // Award-Winning Estate Planner

COVID-19 Update: We are open and working safely by video conferencing!

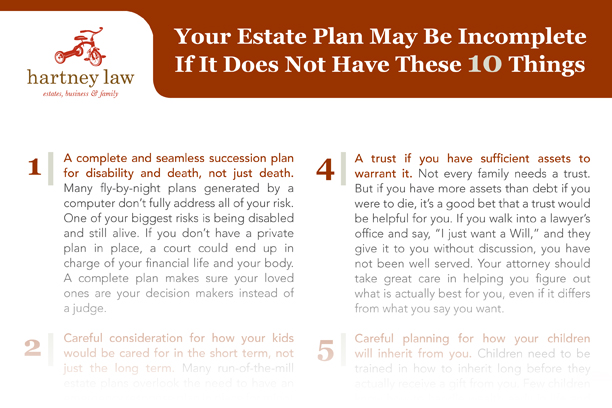

Nothing saps your energy like worry. We know. We’re parents too. Because we want you to sleep at night knowing you’ve done everything you possibly can to secure your family’s future, we’d like to share with you some missing ingredients in estate plans we’ve seen over the years. As an award-winning estate planner, we know that if your estate plan is missing even one of these things, you should seek the help of a qualified attorney who will make sure you have the peace of mind you need to live the life you want. So, how do you ensure that you have a complete estate plan? Here are the 10 Things You Need for a Complete Family Estate Plan.

Moms and Dads in the original relationship that brought their darling boys and girls into the world. Whether you were married or are a common law couple (you might be and not even know it!), you probably have questions about what would happen to your kids if something happened to you.

Moms and Dads living on their own have special needs when it comes to protecting their kids and providing for them. Whether there’s a co-parent or not, single parents should take the time to understand what could happen in an emergency. We can give you the information you need to make sure you’re comfortable with your plans.

When step-parents, kids and siblings are involved, even more intention is required when planning. Blended families may need marital and property agreements to help ensure that all children are cared for while also providing for spouses.

Today’s families are rarely simple anymore. Often more than two generations or non-consecutive generations live together. Grandparents, kids, grandkids and beyond should all be considered in these circumstances.

Moms and Moms, Dads and Dads! Mom, Mom and Dad! Because your rights aren’t fully recognized everywhere (yet), it’s vital that you protect your loved ones using as many estate planning tools as possible. We can help you determine the most effective layered protections available and put your plan into place so you never have to worry about being lost in the fray.

If you or your partner, or both, are not U.S. citizens, you have unique child custody and gift/estate tax issues that require specific attention beyond what other couples may encounter. We can help you navigate these complexities so you can rest easy that your family would be provided for and children cared for by the guardians you choose in this or your country of origin.

Business planning for maximum tax relief and liability protection is critical to your business and your life. In addition, most small business owners have not considered what would happen to their life’s work if something happened to them. Your business needs “estate” planning too (it’s just called business succession planning instead).

Are you ready to embark on making your dreams come true? We’ll help you lay a strong foundation for your business that can support its growth for the long term. Build it like you mean it! We’ll help you set sail!

Doctors, lawyers, accountants, any profession at risk of litigation for malpractice could benefit from advanced asset protection strategies that we can help you build right away. A critical issue in asset protection is making sure it’s in place before it’s ever needed.

Have you been named as a trustee or a personal representative (executor) for someone else? Acting as a trustee is a big responsibility. Take it seriously and get the support you need to do the job right. We can help you get and stay organized, understand your responsibilities and fulfill your fiduciary duties.