Hartney Law is pleased to announce it’s sponsorship of a new event series, Power Ups for Parents! These events are held at PrAna in Boulder, on selected Thursday evenings at 5:30pm. These events offer highly relevant, practical information to parents in a FUN, lighthearted environment: CURRENTLY PLANNED SPEAKERS & TOPICS: Aaron Perry, life hacks for families: […]

Category Archives: Estate Taxes

Estate Planning for Boulder Parents

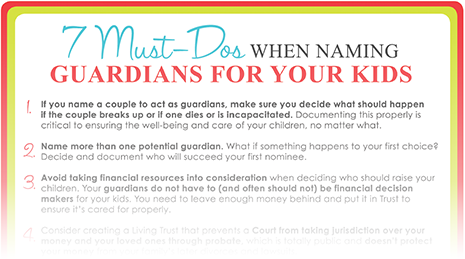

Wine and Cheese Parents’ Night Out! Estate Planning for Boulder Parents Here’s what we’ll cover: How to choose guardians for your children and not make any of the six common mistakes parents and lawyers make when naming guardians Why naming permanent guardians is just not enough to keep your children from spending time in foster care How to put your […]

How Can I Talk to My Parents About their Estate Plan?

What You Don’t Know About Your 401(k) Can Hurt You!

You have a 401(k), right? Sure you do. And you have one (or more) because everyone tells you it’s a heck of a deal. But has anyone ever told you that your IRS qualified fund strategy could end up being a horrible weight on your retirement?

Every January, you opt in to contribute to your 401(k) the maximum allowed that year. You’ve been told over and over that this type of retirement fund will become a nice big nest egg for your retirement on dollars you never paid tax on! Isn’t that something?! What could possibly be wrong with stiffing Uncle Sam every year for the taxes you owe on that maximum contribution?

Well, a lot, actually.

Photo by Nicki Varkevisser on Flickr (http://www.flickr.com/photos/clickflashphotos/)

Picture this…

The Down Low on the New Tax Law and Your Estate Plan

Tax laws are confusing on a good day–what you can deduct, what you can claim–And with all the recent changes to the laws, it’s almost impossible to know if you’re doing the right thing. Hopefully, this will help. Here’s the straight scoop on how the new tax law affects your estate plan: A Quick and Dirty […]